The smart Trick of Palau Chamber Of Commerce That Nobody is Discussing

Table of ContentsEverything about Palau Chamber Of CommerceRumored Buzz on Palau Chamber Of CommerceGet This Report about Palau Chamber Of CommerceFascination About Palau Chamber Of CommercePalau Chamber Of Commerce for BeginnersThe Single Strategy To Use For Palau Chamber Of Commerce

While it is risk-free to say that most philanthropic companies are respectable, organizations can definitely struggle with some of the very same corruption that exists in the for-profit business world. The Message found that, between 2008 and also 2012, more than 1,000 not-for-profit organizations checked a box on their internal revenue service Type 990, the income tax return kind for excluded companies, that they had actually experienced a "diversion" of possessions, suggesting embezzlement or various other fraud.4 million from acquisitions linked to a sham business started by a previous assistant vice president at the organization. Another example is Georgetown College, who endured a significant loss by an administrator that paid himself $390,000 in extra compensation from a secret savings account formerly unknown to the college. According to government auditors, these tales are all too typical, and offer as sign of things to come for those that endeavor to produce and operate a charitable organization.

When it comes to the HMOs, while their "promo of health for the benefit of the neighborhood" was deemed a charitable function, the court identified they did not operate mostly to benefit the area by giving health services "plus" something extra to profit the neighborhood. Therefore, the cancellation of their excluded status was supported.

How Palau Chamber Of Commerce can Save You Time, Stress, and Money.

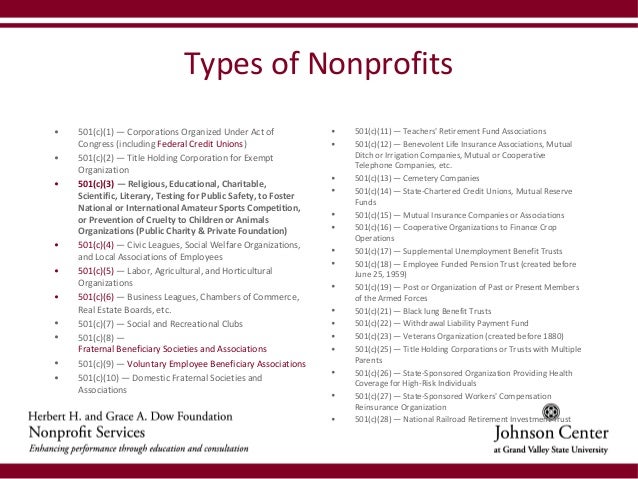

By comparison, 501(c)( 10) companies do not attend to settlement of insurance policy advantages to its members, therefore may prepare with an insurance business to provide optional insurance policy without jeopardizing its tax-exempt status.Credit unions and various other common financial organizations are classified under 501(c)( 14) of the IRS code, and also, as part of the financial industry, are heavily controlled.

Federal lending institution are organized under the Federal Cooperative Credit Union Act and also are tax obligation excluded under IRS code Section 501(c)( 1 ). Other credit rating unions as well as not-for-profit financial organizations are covered by 501(c)( 14 ). State-chartered cooperative credit union must demonstrate that they are hired under the pertinent state credit history union regulations. In our next component, we will look at the demands and actions for incorporating as a not-for-profit.

Some Known Incorrect Statements About Palau Chamber Of Commerce

Getty Images/Halfpoint If you're considering beginning a not-for-profit company, you'll intend to comprehend the various sorts of not-for-profit designations. Each classification has their own demands and compliances. Below are the sorts of not-for-profit designations to help you decide which is ideal for your company (Palau Chamber of Commerce). What is a not-for-profit? A not-for-profit is a company running to further a social cause or sustain a shared objective.

Offers payment or insurance coverage to their members upon illness or various other traumatic life events. Subscription has to be within the very same office or union.

g., online), even if the not-for-profit does not straight obtain contributions from that state. Additionally, the IRS needs disclosure of all states in which a nonprofit is registered on Kind 990 if the not-for-profit has income of even more than $25,000 per year. Fines for failing to sign up can include being compelled to return donations or encountering criminal costs.

The Ultimate Guide To Palau Chamber Of Commerce

com can help you in signing up in those states in which you plan to obtain contributions. like it A nonprofit organization that obtains significant parts of its income either from governmental resources or from straight payments from the general public may certify as an openly sustained organization under section 509(a) of the Internal Income Code.

A nonprofit firm with company locations in multiple states may form in a single state, after that register to do organization in other states. This means that not-for-profit companies should officially sign up, file annual reports, as well as pay annual costs in every state in which they perform company. State legislations need all not-for-profit companies to maintain a signed up address with the Assistant of State in each state where they operate.

What Does Palau Chamber Of Commerce Do?

A Registered Agent gets and forwards crucial lawful files as well as state correspondence on part of business. All firms are generally called for to file annual reports as well as pay franchise business costs to the state in which they're included; nonetheless, nonprofits are frequently exempt from paying franchise business costs. Furthermore, nonprofits are normally called for to annually restore their enrollment in any kind of state in which they are registered.

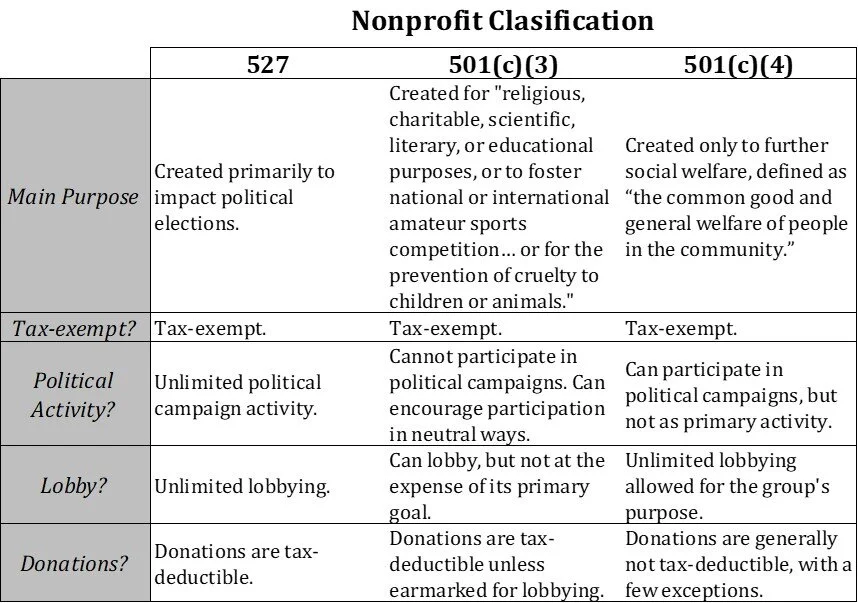

As an example, area 501(c)( 3) charitable organizations may not intervene in political campaigns or perform significant lobbying tasks. Consult a lawyer for more certain details regarding your organization. Some states only require one director, however most of states call for a minimum of 3 directors.

A business that offers some public function and consequently delights in unique treatment under the legislation. Nonprofit firms, in contrast to their name, can make a revenue yet can't be designed why not check here mostly for profit-making. When it pertains to your company structure, have you considered organizing your endeavor as a nonprofit corporation? Unlike a for-profit business, a nonprofit may be qualified for sure advantages, such as sales, building as well as income tax exemptions at the state degree.

Rumored Buzz on Palau Chamber Of Commerce

With a not-for-profit, any kind of cash that's left after the organization has actually paid its costs is placed back into the organization. Some types of nonprofits can get contributions that are tax obligation insurance deductible to the person who contributes to the organization.